In October 2014, we examined the mixed blessing of declining oil prices for small businesses. As we noted then, for those businesses that are in the ecosystem of oil production and distribution, there is an extreme negative impact. For most small businesses outside of that ecosystem, the impact can be like a tax cut in which billions of dollars are left in the pockets of consumers. It’s now 18 months later (April 2016) and the price of oil is still considered “too low” by those who made major investments based on high oil prices. But what about the rest of us? What does continued low oil prices mean for small businesses and consumers in 2016?

The Mostly Good and Somewhat Bad News

Ryan Ermey of Kiplinger Finance Magazine says whether or not low-priced oil is good for your business still depends on where you live and what business you are in. As we noted in 2014, if your company is a part of the oil production and distribution ecosystem, your tough times will continue. Even if your business is indirectly a part of the oil ecosystem (say, you own a diner in a region of the country where oil is produced), these will continue to be challenging times. For others, however, lower energy costs are similar to a major tax cut.

What to expect if oil prices continue to stay low

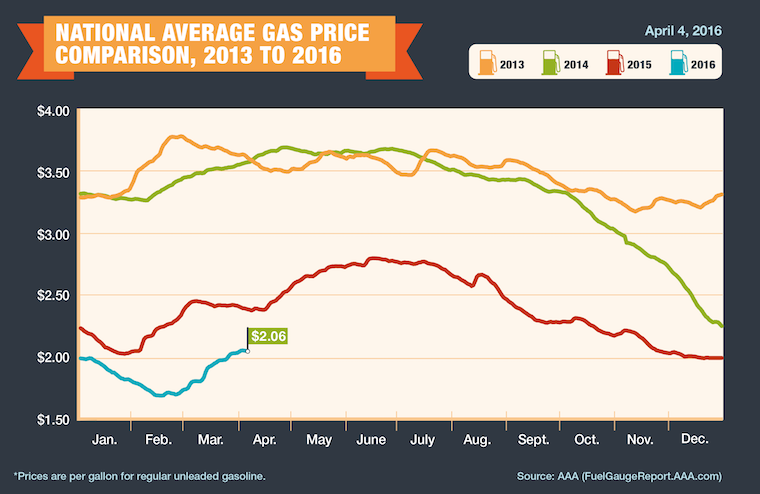

You’ll continue to pay less for gasoline.

$2.04 | Average retail price of a gallon of regular gasoline (4/11/2016)

$2.40| Average retail price of a gallon of regular gasoline (4/11/2015)

36¢ | Savings per gallon year-over-year

$7.20| Savings per tank full (20 gallons, year-over-year )

Source: American Automobile Association

You’ll pay more for car insurance.

Lower prices mean more drivers on the road. More drivers on the road increase the liklihood of accidents. More accidents mean higher insurance premiums, says James Lynch, chief actuary at the Insurance Information Institute.

You may be able to save some on airfare.

Lower fuel costs for airlines should mean lower airfares (but airlines are also trying improve their battered bottom lines). Delta, United, American and Southwest are offering historically low fares on some domestic routes, says George Hobica, founder of AirfareWatchdog.com.

Bottomline: Lower priced oil is a net positive for the economy

“As consumers begin to realize that this drop in gas prices isn’t just a one-off, more confident consumers will begin to open their pocketbooks.” says Michael Hanson, an economist at Bank of America Merrill Lynch.

Via: Kiplinger.com