When you begin hiring employees, a decision you must make is how to set up a payment schedule. Such a decision may seem unimportant, but decisions you make early can set into place hard-to-change policies. Also, your decision can result in unnecessary costs associated with administering payroll.

Each time you process payroll, you are going to incur a cost. Whether that cost is in opportunity related to the time you take away from more productive activities to do it yourself, or in the fees charged by a payroll processing firm. The fewer times you process payroll, the more you’ll save. So, you could save a great deal if you were able to convince your employees to be paid, say, once a decade. However, that’s not likely to happen. In most circumstances, your payroll schedule will be one of these:

Weekly

Typically, the weekly payroll is reserved for industries considered “trades” like plumbing, construction, etc. or for hourly and part time workers, especially seasonal staff. Weekly payrolls can be a challenge to administer, especially if they involve fluxuating hours or overtime pay.

Twice monthly, or every-other week

We find the terms “semi-weekly” or “bi-monthly” confusing, so we go with these two terms that may sound like the same thing, but are quite different. Twice monthly means you will have 24 pay periods per year (12 months x 2): typically on the 15th and last day of each month. Every-other week payments mean that you will have 26 pay periods per year (52 weeks/2). A lot of the decision will be determined by what is customary in your line of work. The most efficient and economically wise of the two options is the twice monthly choice.

Monthly

Some large institutions, like universities or government agencies, have monthly payrolls. Employees in most small businesses (where the scheduled can’t be blamed on some far-away bureaucrat) will let you know quickly that monthly is not a good policy.

Other>

There are exceptions to any standard payrolls ranging from daily (for day laborers, for example) or quarterly, for certain types of commission-oriented payment arrangements.

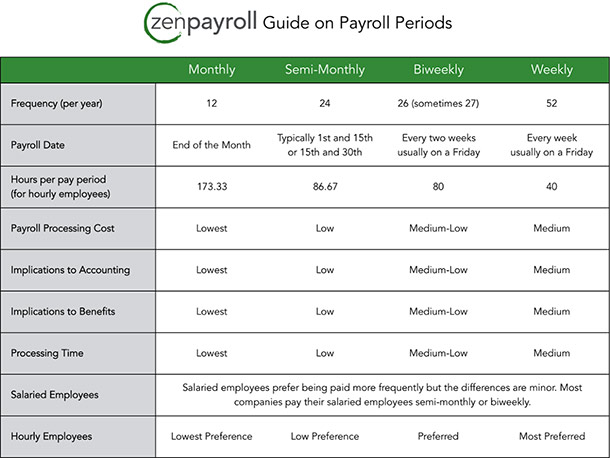

Here is a chart from ZenPayroll.com that provides a comparative look at the options outlined above: