Whether you’re a freelance writer, food truck owner, fashion boutique operator, on-the-go financial consultant or flea-marketing regular, you’ve discovered that smartphone credit card readers are the current big thing for transaction-oriented small businesses. As a result of the rapid adoption of smartphone plug-in processing, this niche of the payment processing industry has grown quickly, and competition is becoming fierce.

Square, the company started by one of the Twitter founders, has the most visibility in the startup and tech world, but there are plenty of competitors. And since Square’s announcement last week (perhaps in anticipation of going public next year) that it will be offering a per-month fee option in addition to their per-transaction fee (an option that will appeal to high volume, high value transactions), small businesses may be even more confused–and enticed–by all the options out there.

Here’s a rundown of Square and its competitors, with a warning: The players in this field constantly change fee structures and features as the niche shakes out. Indeed, since we started working on this post, fees have changed at several providers. As with other financial decisions, talk with your business financial advisor before deciding which service to use.

1. Square

(Photo: on Flickr via touristic32)

Since 2010, Square has led the way as a mobile payment service because it was the first one available–and its brand almost defines the niche. The square white plug-in for smartphones and tablets offers ways to organize and chart payments on your mobile device. It takes 2.75 percent of each purchase plus an additional 3.5 percent for cards that are keyed in instead of swiped. Last week it announced a new $275 monthly fee option (for up to $250,000 in transactions per month).

2. Paypal Here

(Image: on Flickr via paz.ca)

PayPal Here syncs with a small business’s PayPal account so both physical and online transactions occur in one account. PayPal processes transactions instantly and charges 2.7 percent (the same as Square) per transaction.

3. Groupon Breadcrumb

(Photo: via groupon.breadcrumb)

The Groupon Breadcrumb charges 1.8 percent + $0.15 per swipe, making it the cheapest mobile payment service on the market. The service’s processing takes exactly one business day and has no cancellation fee. Groupon offers a free statement analysis for potential customers so they can calculate how much they will save by switching from another mobile payment service provider.

4. Dwolla

(Image: via Dwolla)

Dwolla is a mobile payment service that does things differently. Instead of processing cards, Dwolla links directly to your bank account, allowing you to move money for 25¢ per transaction or for free for transactions under $10. One extremely major hitch: The service works only with other Dwolla users.

5. Intuit. Go Payment

(Photo: via Intuit.GoPayment)

Intuit’s Go Payment works especially well with users of its popular small business accounting software, Quickbooks. Go Payment transactions sync directly with Quickbooks, so all of your small business transactions flow directly into your Quickbooks online account.

6. Pay Anywhere

(Image: via Pay Anywhere)

Owned by North American Bancard, Pay Anywhere has been processing credit cards for the last two decades. Its mobile payment service offers 24/7 over-the-phone tech and customer service. Pay Anywhere charges 2.69 percent per swipe. Downside: It only works with Apple products.

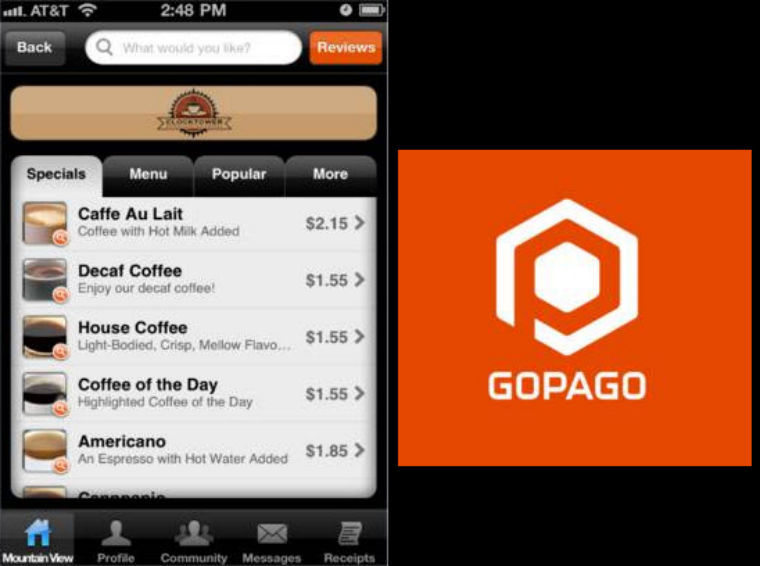

7. GoPago

(Image: via GoPago)

In addition to typical POS payment processing, Gopago lets users pay for items before they even walk into your store. This feature is intended to streamline the entire shopping experience by making it more convenient. User fees offer flexible payment options with no upfront costs. GoPago is $69 per month with no contract.

(Featured Image: Squareup.com)

SmallBusiness.com staffers Rex Hammock and David Hollerith contributed to this post.