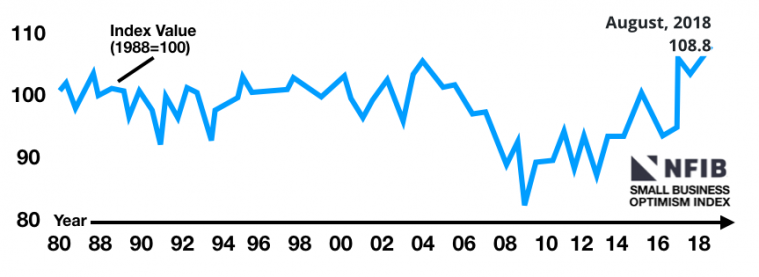

The NFIB Small Business Optimism Index reached 108.8 in August, a new record in the survey’s 45-year history. The previous high was July 1983 when the index reached 108. According to NFIB Chief Economist William C. Dunkelberg, “the record-breaking figure was driven by small business owners executing on the plans they’ve put in place due to dramatic changes in the nation’s economic policy.”

August index highlights

- Job creation plans and unfilled job openings both set new records.

- The percentage of small business owners saying it is a good time to expand tied the May 2018 all-time high.

- Inventory investment plans were the strongest since 2005 and capital spending plans the highest since 2007.

Labor | After posting significant gains in employment in July, the velocity of job creation slowed some among small firms in August. Still, the survey hit a 45-year record in job openings

3.2 workers | Average need of workers per firm

62% | Percentage of surveyed businesses that reported hiring or trying to hire

55 % | Percentage of owners reporting few or no qualified applicants for the positions they were trying to fill.

25% | Record high percentage of owners citing the difficulty of finding qualified workers as their Single Most Important Business Problem

38% | Owners reported job openings they could not fill

17% | Percentage of owners using temporary workers (up 4 points). CAPITAL SPENDING

Sales

10% | Reported higher nominal sales in the past three months compared to the prior three months

35%| Percentage of owners in construction, manufacturing, the wholesale trades and transportation who reported sales volumes gains.

Compensation and Earnings | Reports of higher worker compensation remained unchanged at a net 32 percent among all firms (3 points shy of May’s record reading of 35 percent)

Credit | Only 5 percent of owners reported that all their borrowing needs were not satisfied, unchanged and just 1 point above the record low. “In short, credit availability and cost are not issues and haven’t been for many years, even with the Federal Reserve raising interest rates,” said Dunkleberg.

33% | Reported all credit needs were met (up 1 point)

51% | Said they were not interested in a loan (up 1 point and historically very low)

2% | Reported that financing was their top business problem (unchanged).

5% | Reported loans “harder to get.”

What index components contributed to the record high? |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Source | NFIB Research Center, Chief Economist William C. Dunkelberg and Director of Research and Policy Analysis Holly Wade

You can download the full report at NFIB.com

GettyImages