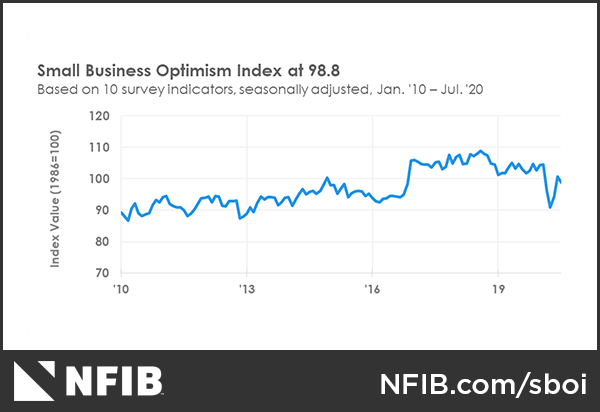

The National Federation of Independent Business (NFIB)’s long-running “Small Business Optimism Index” fell 1.8 points to 98.8 in July. Small business owners continued to temper their expectations of future economic conditions as the COVID-19 pandemic is expected to continue.

“This summer has been challenging for many small business owners who are working hard to keep their doors open and remain in business,” said NFIB’s Chief Economist Bill Dunkelberg. “Small business represents nearly half of the GDP and this month we saw a dip in optimism. There is still plenty of work to be done to get businesses back to pre-crisis numbers.”

Key findings in July’s small business owner index

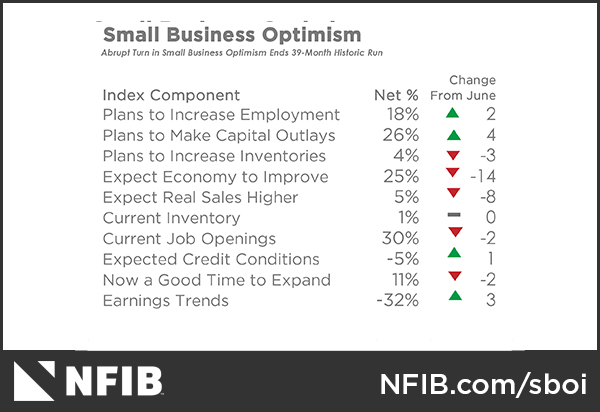

18% | Job creation plans increased two points to a net 18%.

5% | Five percent acquired new buildings or land for expansion

10% | Spent money for new fixtures and furniture.

26% | Planning capital outlays in the next few months.

“Even with states reopening, sales are often lower due to business restrictions, social distancing requirements, and a still-reduced willingness of consumers to go out and mingle with the general population.”

A net 15% of the owners surveyed reported raising compensation (seasonally adjusted), remaining well below the 36% reading in February before COVID-19 policies were implemented in March. A net 13% plan to do so in the coming months. Eight percent cited labor costs as their top problem, unchanged from June’s reading.

Twenty-one percent of owners selected “finding qualified labor” as their top business problem, with 37% in construction. The COVID-19 disruption for millions of workers did not change the skills of the existing workforce.

The frequency of reports of positive profit trends rose 3 points to a net negative 32% reporting quarter on quarter profit improvement. The major cause of profit weakness is weak sales.

3% | Percentage of owners who reported that all their borrowing needs WERE NOT satisfied

35% | Percentage of owners who reported that all their credit needs WERE MET

51% | Were NOT not interested in a loan

2% | Reported their last loan was harder to get than in previous attempts.

See: NFIB Small Business Economic Trends Surve

Photo Credit: GettyImages