You don’t need a law degree to start a small business, but consulting a business attorney will help you avoid these 5 common and costly legal mistakes. So will thoroughly documenting everything related to your business structure, partners and employees. But please don’t take our word on it. That’s what lawyers are for.

1. Never establishing a business arrangement

(Image: via wikimedia commons)

One of the first things you should do is write a clear, comprehensive description of your business arrangement, including the roles and responsibilities of co-founders and partners, salaries, future compensation agreements, etc. For an example of what can happen when you overlook this step, see Zuckerberg/Winklevoss Facebook litigation.

2. Failure to establish a legal business structure

(Images: via wikimedia commons)

Decide what kind of business structure you want—sole proprietorship, partnership, corporation or a Limited Liability Company (LLC)–and document it. These structures offer different levels of protection to your personal assets in case of lawsuits, and they also have different tax ramifications.

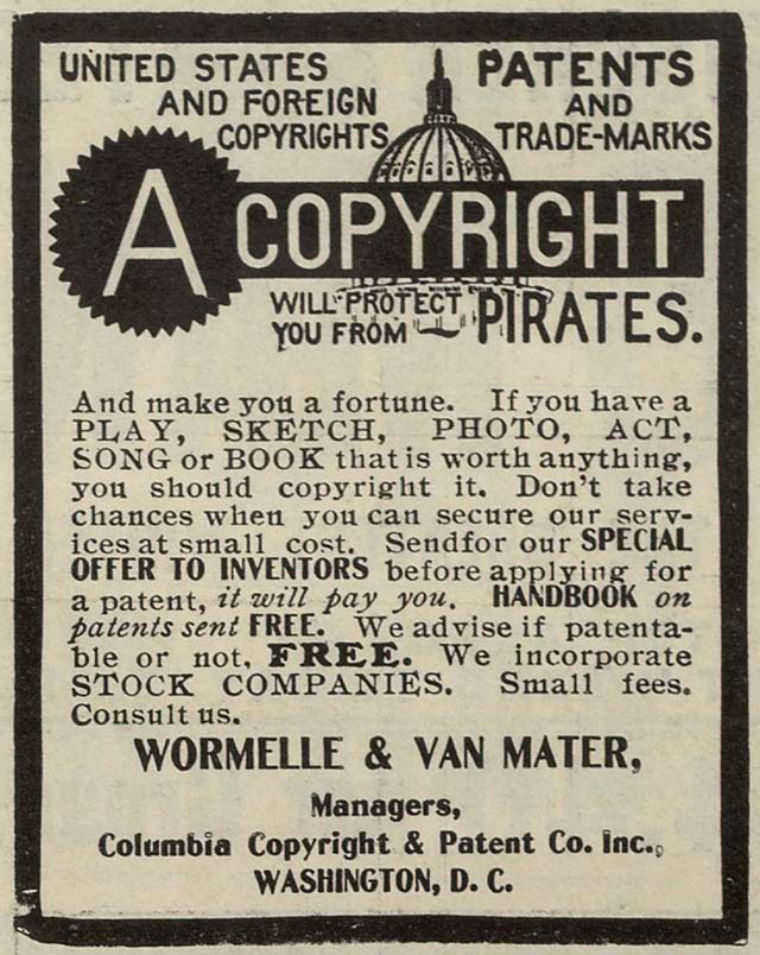

3. Not obtaining trademarks, patents or copyrights

(Image: via wikimedia commons)

Believe us: You don’t want to be hassled by something like a trademark infringement complaint. Do lots of research before you pick a company name, logo or trademark to make sure someone else isn’t already using it.

4. Neglecting the use of written contracts

(Image: via wikimedia commons)

There’s an old saying that a verbal contract isn’t worth the paper it’s written on. Always have a written contract—this can be even more important between friends or with family members, since more than just business is at stake.

5. Employee documentation and the treatment of individual workers

(Image: via thinkstock)

Tempted to pay under the table or designate employees as independent contractors to save money or avoid taxes? That’s a great way to get the IRS and a few of your state governmental agencies into your small business. Tackling safety issues, setting up the proper office environment, and complying with all types of state and federal employment guidelines are important parts of the job of being a small business owner.

(screenshot)

On the SmallBusiness.com WIKI: Legal Hub