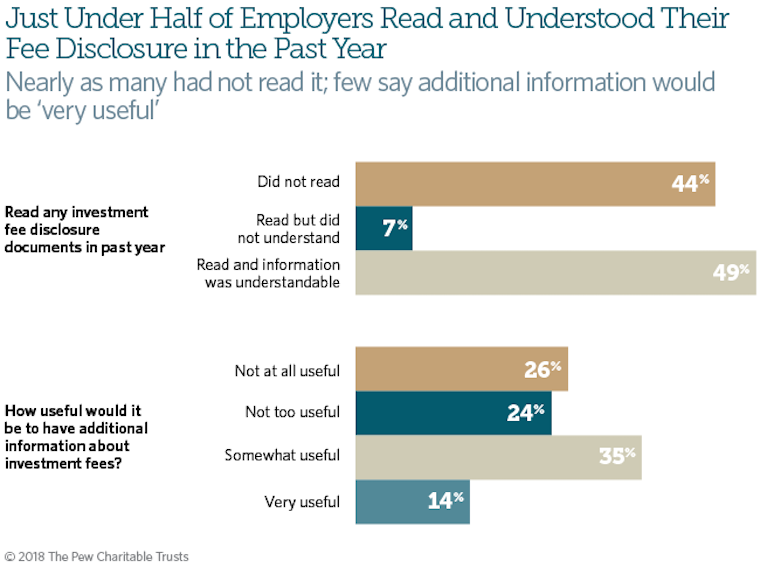

The majority of U.S. small business owners, managers and workers say they have only a limited knowledge of the fees paid to manage their company-sponsored retirement plans, according to surveys released last month by the Pew Charitable Trust. Having limited knowledge about such fees can be detrimental to the long-term finances of both employers and employees.

19% | Percentage of small business owners and managers who said they were “very familiar” with their retirement plan fees

34% | Said they were “not at all familiar” with those fees.

31% | Said they were not familiar at all with the fees.

Why it is important to know about your retirement plan’s fees

Earlier research by Pew showed that leaders of many small businesses may not offer retirement plans because their companies lack the administrative capacity to do so.

Increasing awareness among employers and workers about the impact of fees on long-term savings will probably improve retirement security more broadly.

Finding ways to help these decision-makers analyze and compare features, such as fees, could encourage more to sponsor plans, according to the Pew Charitable Trust’s John Scott and Sarah Spell, authors of the report.

Officials are taking steps to increase transparency of fees

Federal officials have recently taken steps to increase transparency and make the details easier to comprehend. For example, the U.S. Department of Labor in 2012 set standards for financial services companies that provide defined contribution plans, such as 401(k). Those standards require such firms to present fees more uniformly: as a percentage of assets and as a dollar amount for each $1,000 invested.

See | U.S. Department of Labor’s “Understanding Your Retirement Plan Fees”