According to the Brewers Association, small and independent brewers* continued to gain market share from beer industry giants in 2015. During the past seven years, such breweries have seen their market share of retail beer sales increase from six percent to 21 percent. In this article, Steve King, partner at Emergent Research and a regular contributor to SmallBusiness.com, observes how the consolidation of big businesses and the proliferation of small businesses have made the craft beer industry an example of what is taking place with market share in many industries, something he calls, “the barbell effect.”

In almost every industry Emergent Research tracks, we see consolidation resulting in fewer, but much larger, global corporate giants. At the same time in those same industries, we also see growing numbers of small businesses and declining numbers of mid-sized businesses.

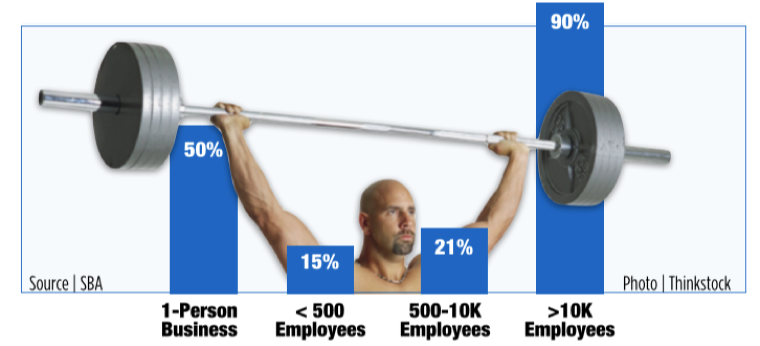

This results in a “barbell effect” where growth can be found at the extremes: among small and independent businesses and among rapidly consolidated global corporations. Less growth is seen “in the middle.”

Also on SmallBusiness.com | Tips from Craft Breweries on Starting a Business

The Barbell Effect

Percentage growth of businesses of different sizes (as measured by number of employees) from 1992 to 2009

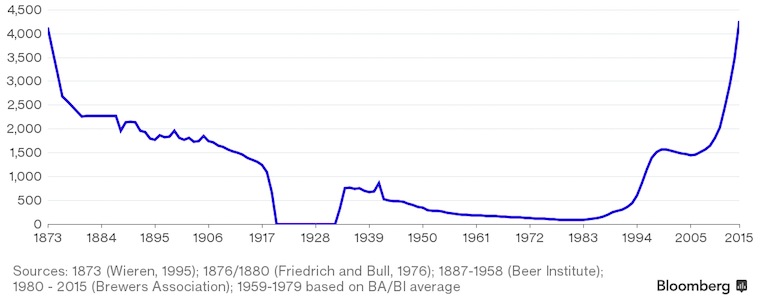

The fall and rise of the local brewery | 1873-2015

An excellent example of the barbell phenomenon is the beer industry where, over a 140-year-long period (with a gap for Prohibition), the number of commercial beer breweries has gone from 4,000 breweries to a period of very few, but large, brewers back to the present era: one in which it seems like there is a craft brewery on every corner in some cities. According to the Brewers Association, 99 percent of all brewers fall into the small and independent category.

Graph: Bloomberg

By the Numbers | Small and Independent Brewers | 2015

122,000 | Jobs in the craft beer industry (breweries, brewpubs, craft brewers)

+6,000 | Job growth, year over year

12% | Market share of overall beer sales

21% | Market share of retail beer sales

24.5 million | Barrels produced by small and independent brewers

13% | Increase in barrels produced, year-over-year

16% | Increase in retail dollar value sold, year-over-year

4,269 | Total number of small and independent breweries

2,397 | Microbreweries among that total

1,650 | Brewpubs among that total

178 | Regional craft breweries among that

15% | Increase in the number of operating breweries, year over year

99% | Percent of all brewers that are small or independent

“Because the topic is a bit esoteric, the shift to barbell industrial structures doesn’t get a lot of attention. But it’s one of the most important trend that is creating new opportunities for small businesses and independent workers.”

Steve King, Emergent Research

Photos: Thinkstock

*Definitions via Brewers Association: “An American craft brewer is small, independent and traditional. Small: Annual production of 6 million barrels of beer or less (approximately 3 percent of U.S. annual sales). Beer production is attributed to the rules of alternating proprietorships. Independent: Less than 25 percent of the craft brewery is owned or controlled (or equivalent economic interest) by an alcoholic beverage industry member that is not itself a craft brewer. Traditional: A brewer that has a majority of its total beverage alcohol volume in beers whose flavor derives from traditional or innovative brewing ingredients and their fermentation. Flavored malt beverages (FMBs) are not considered beers.