Borrowing by small businesses has been on the decline for several years, according to ongoing research by the Small Business Administration’s Office of Advocacy. There are several reasons for this decline–and even economists disagree on the causes. Declining need for capital during a period of slow economic growth is an obvious reason. Another contributing factor could be the increased regulation of banks after 2008 has caused the cost of lending money more expensive, thereby incenting banks to focus on higher margin loans to big businesses.

Another reason, one we’ve reported on for over two years (if you are viewing this on SmallBusiness.com, see above: the SmallBusiness.com Guide to Alternative Financing), may be the growth of “alternative financing” options. In many cases, traditional banks and companies like Sam’s Club and Square are even serving as lead-generating partners for alternative financing companies. Alternative financing, as we’ve noted previously, is not without controversy.

The Small Business Administration’s Office of Advocacy is producing a series of issue briefs on alternative finance options, “including their tradeoffs” (translation: don’t make financial decisions without help from trusted advisors including your accountant, lawyers and several bankers) that outline various alternative financing options. The following is an abbreviated version of the overview of this series.*

What are traditional forms of business financing?

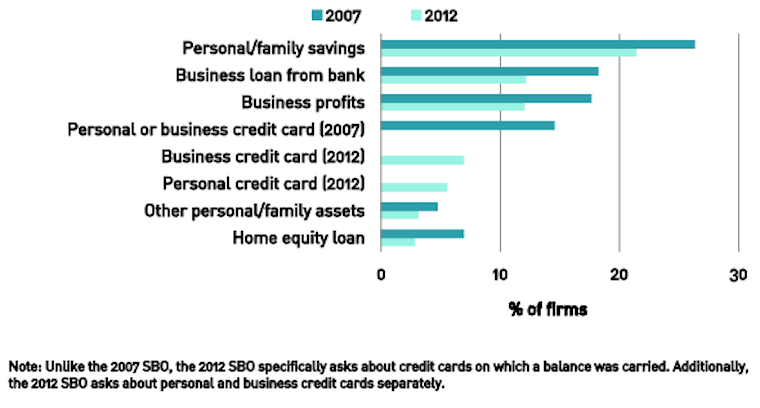

In order to understand alternative financing, it is helpful to consider the traditional mix of small business financing. The most commonly used sources of small business expansion capital in 2007 and 2012 can be seen in the chart below. Altogether, they can also be grouped in these three baskets.

- Personal assets

- Reinvested business profits

- Financing sources originating in banks

Sources of Expansion Financing, Employer Firms Source: Survey of Business Owners, U.S. Census Bureau

Sources of Expansion Financing, Employer Firms Source: Survey of Business Owners, U.S. Census Bureau

What are alternative forms of business financing?

While there is no single authoritative technical definition of “alternative finance,” it can be identified as financing from external sources other than banks or stock and bond markets.Unlike traditional sources of expansion capital, alternative finance draws from other sources and generally over internet platforms, ranging from individual investors to non-bank lending companies. In addition, some definitions emphasize the direct connection of fundraisers with funders, often via online platforms.

Characteristics of alternative finance:

- Rely on new methods of evaluating credit

- Require different criteria for funding (i.e., relying less on collateral)

- They may consider new metrics or indicators of creditworthiness

Types of alternative finance

Crowdfunding

Crowdfunding, the pooling of small amounts of money from many investors through internet platforms, is one of the better-known forms of alternative finance. In the United States, the three most common forms of crowdfunding are:

Donation- and rewards-based crowdfunding | In this fundraising model, investors give money without expecting financial compensation (i.e., donations), but, in the case of rewards-based crowdfunding, they receive benefits such as early access to a new product.

Peer-to-peer and peer-to-business lending | These lending approaches are similar in concept to microfinance platforms such as Kiva. They anonymously connect borrowers (individuals or businesses) with multiple lenders; lenders receive interest in return, which distinguishes them from traditional microfinance.

Equity crowdfunding | This form of crowdfunding was authorized in the United States beginning in May 2016. In this model, investors receive an equity stake in the company, similar to purchasing stocks.

Some sources distinguish between debt-based securities and peer-based lending. However, in the United States, lenders on peer-to-peer and peer-to-business platforms are technically buying debt based securities, similar to bonds—meaning that these platforms are subject to certain federal regulations.

Two recently emerging models of crowdfunding:

Revenue and profit sharing crowdfunding | In this model, a business receives a loan funded by multiple investors and pays back the full amount based on future receivables, similar to a merchant cash advance.

Invoice trading | With invoice trading, also a form of receivables-based financing, a business sells its invoices at a discount to a pool of individual or institutional investors for cash. This is similar to factoring, except that multiple parties instead of one lender purchase the invoice. Although some sources6 consider invoice trading to be distinct from crowdfunding, it is included here because multiple investors participate.

Online marketplace lending

“Marketplace lending” refers to online platforms that allow one or more investors to make loans directly or indirectly to small businesses. These platforms rely on data-driven algorithms to evaluate the creditworthiness of borrowers, as distinct from traditional banking practices. Installment loans similar to traditional bank loans are available through marketplace lending platforms.

Online marketplace lenders appear particularly significant to smaller businesses. In 2015, the smallest firms were more likely than other firms to apply for financing from an online lender. And the smallest firms were more likely to be approved at online lenders than at large banks or credit unions.

*The full report can be found here on the Office of Advocacy website. Future products in the Alternative Finance Series will include an overview of the regulation landscape and a fact sheet on crowdfunding. As those are released, we will make them available here in support of the work of the Office of Advocacy’s efforts to share this information with small business owners.