(Information in this article is focused on tax-year 2019. While the following information is provided by the IRS, you should always consult with your trusted financial advisors before making any decisions related to businesses or personal taxes.)

Everyone must pay taxes on the income they earn. Taxpayers who earn a paycheck typcially have their employer withhold their federal income tax from their paychecks. However, there are taxpayers whose income is not subject to withholding — certain small business owners or self-employed individuals, for example.

For these individuals, that means making quarterly-estimated tax-payments. As a quarterly taxpayers can tell you from experience, it can be confusing to estimate such payments. This article contains advice for quarterly taxpayers, including information about a new IRS mobile-friendly Tax Withholding Estimator.

IRS tips and advice regarding quarterly estimate tax payments.

- Taxpayers generally must make estimated tax payments if they expect to owe $1,000 or more when they file their 2019 tax return.

- Whether or not they expect to owe next year, taxpayers may have to pay estimated tax for 2019 if their tax was more than zero in 2018.

- Wage earners who also have business income can often avoid having to pay estimated tax. They can do so by asking their employer to withhold more tax from their paychecks.

- Aside from business owners and self-employed individuals, people who need to make estimated payments also includes sole proprietors, partners and S corporation shareholders. It also often includes people involved in the sharing economy.

- Estimated tax requirements are different for farmers and fishermen.

- Corporations generally must make these payments if they expect to owe $500 or more on their 2019 tax return.

- Aside from income tax, taxpayers can pay other taxes through estimated tax payments. This includes self-employment tax and the alternative minimum tax.

- The final two deadlines for paying 2019 estimated payments are Sept. 16, 2019 and Jan. 15, 2020.

More help from SmallBusiness.com | What the IRS wants you to know about car expenses, deductions and taxes, 2019.

The IRS Tax Withholding Estimator

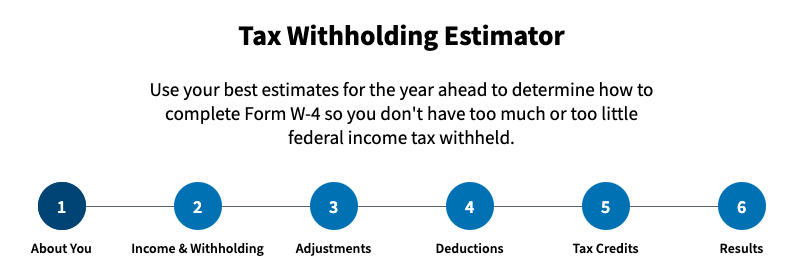

Taxpayers who haven’t yet checked their withholding this year (2019) should do so as soon as possible. All taxpayers can do this by using the new mobile-friendly Tax Withholding Estimator.

According to the IRS, it is a user-friendly, step-by-step tool to help taxpayers effectively adjust the amount of income tax they have withheld from wages and pension payments.

- Using the paycheck checkup can help taxpayers avoid an unexpected year-end tax bill and possibly a penalty when they file their 2019 tax return next year.

- The tool allows taxpayers to separately enter pensions and other sources of income. Taxpayers who receive pension income can use the results from the estimator to complete a Form W-4P. They then give that form to their payer.

- The tool makes it easier to enter wages and withholding for each job held by the taxpayer and their spouse.

- At the end of the process, the tool makes specific withholding recommendations for each job and spouse. It also clearly explains what the taxpayer should do next.

Here are some things the IRS wants you to know about the Tax Withholding Estimator.

More forms, guides and instructions from the IRS

GettyImages | IRS.gov