Each year, we offer many tax tips related to the year’s end. However, we then always note that the worst time of the year to deal with year-end tax issues is the actual end of the year. (Look around and notice how busy you are.) To help you get on top of tax issues year round, the IRS has created a tax calendar that can be viewed online via a computer or smartphone. It can even be integrated with your personal calendar. Here are links to the various flavors of the IRS tax calendar. (As we always remind you when the subject is taxes, check in with your financial or tax advisor, as every individual’s situation is unique.)

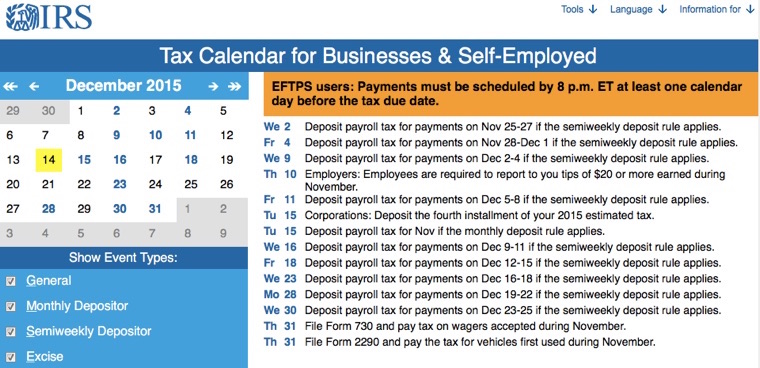

Online Calendar

You can view due dates and actions for each month. You can see all events or filter them by monthly depositor, semiweekly depositor, excise or general event types.

View the Tax Calendar Online (en Español)

Calendar Reminders

You can have Calendar reminders sent to your email inbox via RSS Feeds one or two weeks in advance of when a form or payment is due.

View the Instructions for RSS Feeds (en Español)

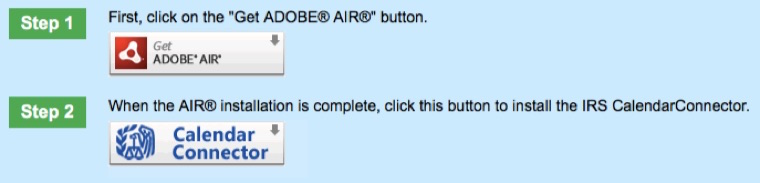

Desktop Calendar Tool

The IRS CalendarConnector provides access to tax calendar events right from your desktop, even when you’re offline. As new events are added, they are automatically updated via the desktop tool.

Install IRS CalendarConnector 2

Subscribe to (or Import into) Your Calendar Program

You have the option to Subscribe to the Small Businesses calendar using Outlook or Mac iCal.

Subscribe

Subscribing adds web calendar data to your calendar program. The web calendar data will be updated automatically, but you will not be able to make manual changes to it.

Download

Downloading lets you add a one-time “snapshot” of the calendar events to your calendar program (e.g. Outlook). Outlook will allow you to edit this imported calendar data, but will not automatically refresh it when data is updated by IRS.

View the Instructions to ‘Subscribe to’ or ‘Import’ the tax calendar

(via IRS.gov)