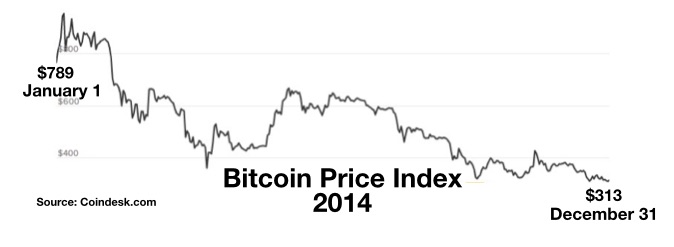

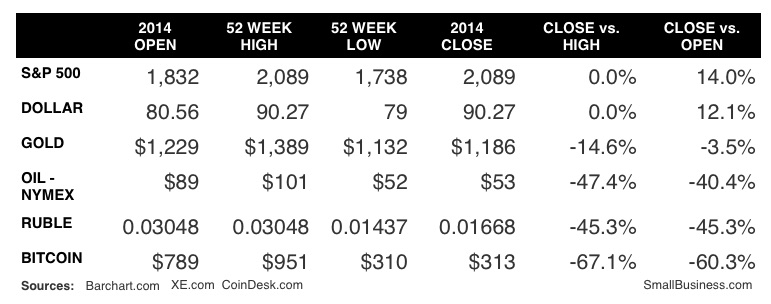

Think Vladimir Putin’s rubles had a rough year? (The currency lost 45% of its value in 2014) Or what about those 27 Wall Street oil analysts who told Reuters that oil would be $100 a barrel by now? (It ended the year at $53.) In hindsight, oil and rubles look like savvy investments when compared to the 60% cliff dive of the virtual currency bitcoin.

While its backers still describe 2014’s crash of bitcoin as a “fluxuation,” these charts compare bitcoin’s “fluxuation” to other currencies and commodities during 2014. Decide for yourself if you’d define bitcoin’s loss of 67% from its 52-week high as merely a fluxuation.

Previously, I’ve noted my skepticism of the claims of bitcoin cheerleaders who say it would be great for small businesses to use: No transaction fees, the backers argue. Even after bitcoin’s value had dropped by nearly 60% in a the first nine months of 2014, this writer for Entrepreneur made the “no transaction fees” argument on why small businesses should accept bitcoin.

So let me get this straight: Such an argument suggests the writer believes that small businesses want to avoid a 3-5% credit card transaction fee so much they would favor a currency that lost 67% of its value from its high of 2014? (Backers of bitcoin will, in an attempt to defend its future, point out that it has dropped by 90% previously. That’s not an endorsement many small businesses will comprehend.)

If bitcoin backers are depending on small businesses to pull the currency through to success, they should review the excitement for bitcoin at the Bitcoin Bowl. (No kidding, there was a college football game called the Bitcoin Bowl.) Or perhaps they shouldn’t, as they’ll only see how little excitement (or even interest) could be found among small merchants in the game’s host city. Only 100 small businesses near the St. Petersburg, Fla., stadium where the ESPN-televised game was played agreed to accept the currency during the lead up to the game. And according to a survey by CoinDesk.com, most of those merchants saw few, if any, actual bitcoin transactions. Adding insult to injury, no vendors for the game accepted the currency either. Neither of the teams in the game (North Carolina State and the University of Central Florida) chose the option they were given to accept bitcoin for payment of their appearance fee, choosing to get paid in hard cash.

Who needs bitcoin?

I can understand why venture capitalist backers and previous internet startup winners desperately want bitcoin to be their next big conquest. These were the titans of the universe who backed and made billions from social-this and disruptive-that and cloud-anything. So, of course the money they’ve put down on bitcoin can’t lose, no?

According to one such billionaire, Robert Byrne, CEO of Overstock.com, who was dubbed “the Messiah of bitcoin” by Wired magazine, “bitcoin has already become too big to fail…this is not a genie (that can be) put back into the bottle.” This, of course, was before the currency lost 67% of its value.

Byrne’s reference to the tagline of the 2008 financial crash and subsequent “Great Recession” is appropriate, as one of the few reforms to result from that nightmare was the creation of the The Consumer Financial Protection Bureau (CFPB), an independent agency of the U.S. government responsible for consumer protection in the financial sector. And one of the first warnings issued by the nascent agency is a warning for consumers to beware of bitcoin.

While bitcoin fits nicely with Byrne’s libertarian beliefs, the Nobel Prize winning economist Paul Krugman used a three-word title for his anti-bitcoin essay in December, 2013: “bitcoin is Evil. (Bryne’s response to Krugman’s essay was a classic ad hominem: “Paul Krugman was great until he went crazy.”)

As I noted a year ago in my small business predictions for 2014, I have no doubt there will one day be a virtual currency that small businesses embrace, but I doubt seriously it will be bitcoin. I realize this is like shouting, “Apple sucks” in the middle of an Apple developers conference, but many people I respect are still playing cheerleader to the bitcoin solution to a problem that can’t be found on long-running surveys of small business problems or priorities.

Bitcoin fails the “Like My Mother Used to Say” test

But let’s skip the “fluxuation” issue a moment.

Like my mother (and your’s) used to say, “People always judge you by the company you keep.” If your mom didn’t say it, then perhaps your U.S. Attorney General did. Late in 2014, the departing Eric Holder told a congressional panel that bitcoin raises new risks for money laundering and other illegal activity. “More than ever before, the Justice Department’s law-enforcement work today must contend with new and emerging technology, including virtual currencies such as bitcoin,” he said. “Virtual currencies can pose challenges for law enforcement given the appeal they have among those seeking to conceal illegal activity.”

After a criminal hacking of up to $500 million (maybe less, maybe more) in bitcoin in March led to the collapse and bankruptcy of Mt. Gox, the largest bitcoin marketplace at the time, Keith Jarvis, a security researcher at Dell SecureWorks told Reuters that “bitcoin is large enough and has enough momentum behind it to survive any public relations damage from this (Mt. Gox) case or anything else.”

How a security researcher became an expert in public relations is a mystery. However, as an expert on small business fears, I can assert that one of the biggest fears a small business owner has is having his or her money parked in an unregulated, uninsured, off-shore virtual currency market that can disappear overnight like Mt Gox.

To small businesses on Main Street, the Mt. Gox meltdown wasn’t merely “bad PR.” Neither is it merely bad PR that bitcoin is the currency of assassins, drug dealers and child pornographers.

The future of bitcoin

To establish a trusted currency (and brand), the corporate and venture backers of bitcoin made the wrong investment in 2014. They chose to pour millions of dollars into running up the valuations of companies they believe will stake out the various types of services and marketplaces for bitcoin users. The failed, however, to invest millions of dollars into providing the necessary stability the currency needed at the point where small businesses may have believed anyone suggesting they use bitcoin had any credibility.

While I still believe viable virtual currencies are in our not-too-distant future, I predict most legal users (and let me underline the word legal) on Main Street will opt for a virtual currency backed by governments rather than those running on algorithms and processed through real banks rather than off-shore ones that disappear overnight.

Bottomline prediction: If bitcoin makes it to the mainstream, it won’t be because it finds a following on Main Street. And if it can’t make it on Main Street, it won’t make it to the mainstream.

Update (January 6, 2015): It didn’t take long for bitcoin to start making 2015 another bad year. (via WSJ.com)

“One of the largest online bitcoin exchanges has temporarily suspended services after losing some 19,000 bitcoins ($5.1 million) in what the company said was a breach of its systems, reviving concerns about the security of the digital currency.”

(Illustration by SmallBusiness.com from photo by Justin De La Ornellas via Flickr, CC 2.0)