During the decade since Katrina’s storm surge flooded 80 percent of New Orleans and destroyed homes and businesses along a hundred miles of Gulf of Mexico beaches in Mississippi and Alabama, a string of disasters—natural and manmade—have revisited the region. Starting later in 2005 with Hurricane Rita and including the BP Oil spill, the disasters have hurt small and big businesses alike. Small and local businesses are less likely to survive such a disaster, however. But when it comes to resilience after a disaster—having the most positive impact, quickest—small and local businesses lead the way. This post is part of a series related to small business disaster preparedness and recovery we are running to mark the tenth anniversary of the most expensive natural disaster in modern U.S. history.

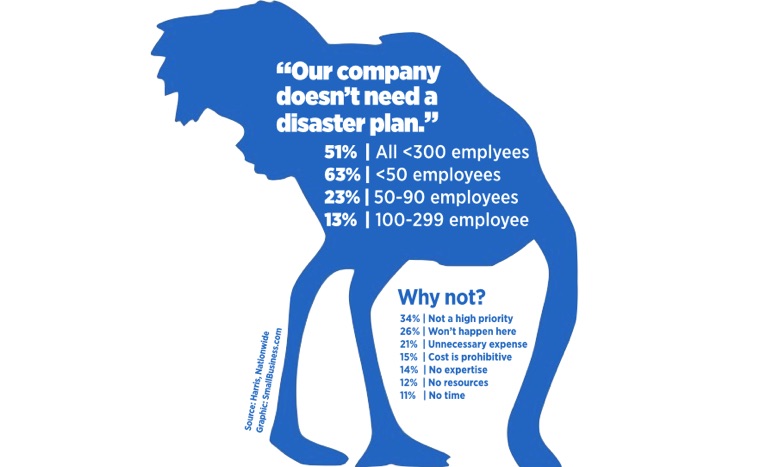

Despite a decade of disasters that began with Katrina and continues to today’s raging fires throughout the drought-plagued West, only 51 percent of business owners of companies with less than 300 employees believe it’s important to have a plan for disaster preparation and recovery, according to a newly released survey from Harris Interactive commissioned by Nationwide, the insurance and financial services company. “Small businesses are least likely to have disaster recovery insurance,” says Mark Pizzi, president and chief operating officer of Nationwide Direct and Member Solutions. “And yet they are the ones most affected by a disaster. That’s why it’s essential for small businesses to have a disaster recovery plan.”

The survey of 500 business owners of companies with less than 300 employees discovered that among businesses with less than 50 employees, only 37 percent have a formal plan for disaster preparation and recovery.

While not a formal plan, some planning takes place

Despite such a low percentage with a formal plan, most have taken certain measures in anticipation of a disaster.

81% | Can work remotely at a home office

80% | Way to reach employees, vendors and customers

77% | Access to alternative suppliers

71% | Vital records duplicate / off-site

56% | Access to generators

41% | Access to temporary office space

17% | Access to temporary store front

Still, disaster denial is prevalent

26% | Don’t believe a disaster will occur in their area

38% | Say it’s not important to have a disaster recovery plan

66% | Don’t have business interruption insurance

And in some cases, the denial is alarming

Among small businesses with less than 50 employees, 60 percent of the owners say a formal disaster plan is not needed (51 percent among all businesses with less than 300 employees). Below: The reasons given by business owners for why their companies don’t need a disaster plan.

Click and share a this graphic.

(Illustration: Wikimedia Commons, Public Domain)