Yesterday, we provided a quick rundown of ways Apple’s new iPhone 6, iPhone 6 Plus and Apple Watch may impact small businesses. As we noted in that analysis, we believe Apple Pay, the company’s new payment processing service, is likely to have the most significant longterm impact on small businesses who accept payment via credit and debit cards (both online and offline). Here are answers (and guesses) to some questions we’ve received from small business owners on Twitter (@SmallBusiness) and via email about Apple Pay.

What is Apple Pay?

Apple Pay is Apple’s entrance into the payments processing arena, an arena already packed with all sorts of competitors who are trying to do some or all of the following:

- Sell you clever devices or apps that mashup all your credit cards into one device

- Protect their existing turf at the checkout counter

- Protect their existing role in the merchant payment system

- Address minor problems (the hassle of carrying around plastic cards)

- Address major problems (when one or many of those plastic cards get lost, stolen or compromised)

- Convince us they have a solution that is secure (see: Target, Home Depot, et al)

What makes Apple Pay different from all of those, and why would Apple even want to compete?

According to Apple CEO Tim Cook, all those problems comprise the kind of challenge that Apple is uniquely qualified to solve. In that Apple is the only company that calls the shots (or outright owns, in many cases) both the hardware and software in its ecosystem, Cook has a point. In reality, Apple isn’t just a technology company and a great marketing company, it is also one of history’s most successful retailing companies. And not just online retail, but the kind of retailing that takes place in the mall, face-to-face. Through iTunes and the Apple Store and thousands of companies that have iPad “cash registers” sitting on their checkout counter, Apple is already in the business of processing tens of billions of dollars in transactions each year.

How can Apple make money from Apple Pay when credit card transaction fees get sliced into many, many thin slices?

Don’t listen to the pundits who may say “a company, even Apple, can’t make money from the sliver of revenue they’ll receive from transactions.” Here’s a history lesson for you. When the iPod first hit the market, there was no Apple iTunes store. Apple made lots of money from selling iPods, however. Soon, iPods were how people saved and organized and played music. Apple decided that even if it couldn’t make very much money from selling music, it made sense for them to become more vertically integrated by also selling music. At the time of the iTunes store launch, they indicated they didn’t expect to generate much profit from the music sales, but, well, you know the rest of the history. Today, Apple makes lots of money selling all sorts of content and apps via the Apple iTunes and Apple Apps stores. But they still generate most of their revenues from hardware devices that store, organize and operate that content and software. (See update at bottom of page.)

When will customers have access to it?

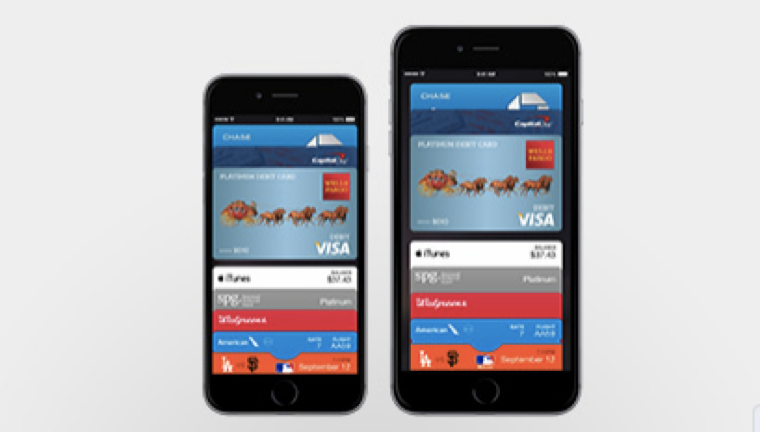

At first, Apple Pay will only be available to consumers who own the new iPhone 6 and iPHone 6 Plus. When the Apple Watch is available in 2015, it will enable older iPhones to use Apple Pay.

When will independent, local and small retailers be able to support purchases made with Apple Pay?

Apple’s first need in establishing Apple Pay as a viable product/service is scale (share of market), so they have already been working to grow the number of big box retailers who accept Apple Pay. However, in theory at least, any company that has a point-of-purchase system with a near-field communication (NFC) chip will be able to support Apple Pay. In the announcement, the company said they were working on ways that would support Apple Pay on “220,000 merchant locations across the US that have contactless payment enabled.” This indicates that the company knows that third-party suppliers of point-of-purchase systems that include NFC capabilities will be key to Apple’s strategy. Encouraging those vendors, and in turn, their clients, to upgrade their systems to NFC supported will be key to reaching small retailers, restaurants and other main street merchants.

If you are such a restauranteur or merchant, you will likely be seeing “Apple Pay supported” as a bullet point feature used in the marketing of your merchant account vendor. It will be like an earlier day when the term “Wifi” was new to us all.

Update: Speaking of Apple making money by giving away stuff

Need more proof of Apple’s ability to use a type of freemium marketing approach in which the company spends millions on giving something away that is then played on Apple hardware it sells? Then let me offer you a free album by U2.

(Christopher Pilny also contributed to this article)